Review

In week 214 $6.72 entered the account in dividends. As planed I added to MO and IWM.

I just finished doing my taxes for 2024. The tax prep fee increased by about 50%. One of the reasons were the K1's. Check with your tax prep firm how they account for K1's tax wise. Not only that they are notoriously late for getting the documents, some tax prep companies charge a fee per K1 during tax season.

As I am in the process of re-structuring a lot of things, I leave things as they are right now. Let's see how that turns out.

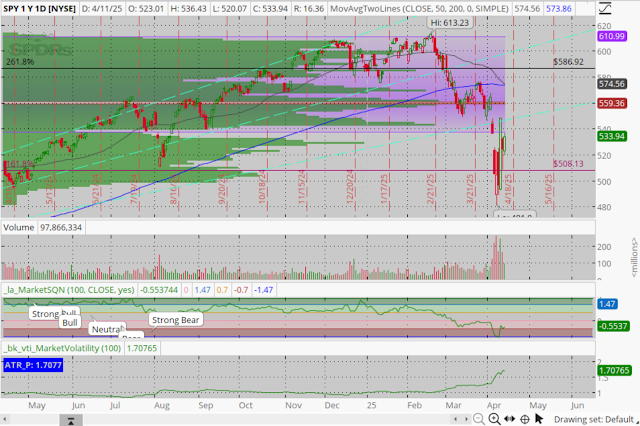

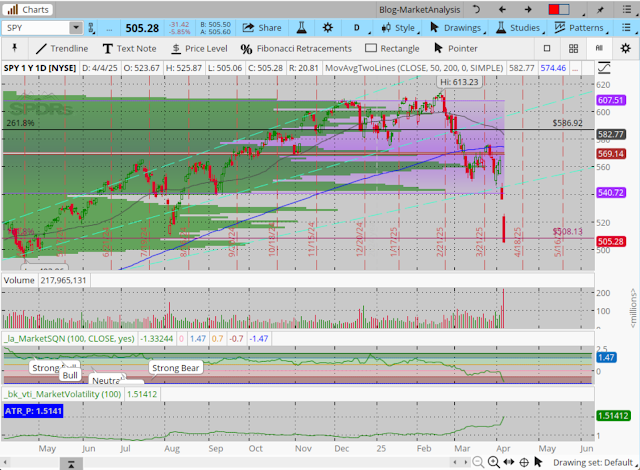

Market Review

Today the news on the ticker was, that phones, computers and other electronics will be exempt from the tariffs. With that I do expect tech stocks to gap up on Monday morning and Nasdaq stocks getting a big boost. It is time to add so those positions.

Plans for next 2 weeks

I still own some fractional shares from AB (see my March post.) I am going to re-establish my position and buy my 7 shares on the market for a lower price than I got last week. AB has a K1, unfortunately, but also has an 9% yield.

For the regular investments, $200 go into CAH and depending what happens on Monday to GOOGL.

Disclaimer

I have been beneficially long with stocks all the items I discuss in the dividend investing. I wrote this article myself and it expresses my own views and opinions. I am not receiving any compensation for this. I have no business relation ship with any company whose stock is mentioned in this article.

I am not an investment advisor or professional. This article is my personal opinion and experience and is not meant to be a recommendation of the purchase or sale of a stock or option. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.